polar-25.ru

Learn

Workers Insurance For Self Employed

Workers' compensation for the self-employed cost are about $20/Month. Find here detailed information about workers' compensation for the self-employed. Where can I buy a self-employed health insurance plan? · Health Insurance Plan Through Your Spouse · Health Insurance Plans Through the Marketplace · Health. Workers' comp for self-employed and independent contractors can provide critical protection. Learn how self-employed workers' comp insurance can help you. Short term disability insurance (STD) provides temporary income protection for employees, typically for up to six months of disability. Long term-disability. If your business is found to have workers that should have been reported for workers' compensation, your business will be held responsible for unpaid premiums. Do self-employed people need workers' compensation insurance? It depends. If you're a sole proprietor and you don't have any employees, most states don't. Cerity offers independent contractors workers' compensation insurance, which can protect them from business disruption and devastating financial losses. Sole proprietors may voluntarily purchase worker's compensation insurance to cover his or her own work-related injuries and illnesses. Generally, if you run your own business and have no employees, or are self-employed, your business won't qualify for group coverage. Workers' compensation for the self-employed cost are about $20/Month. Find here detailed information about workers' compensation for the self-employed. Where can I buy a self-employed health insurance plan? · Health Insurance Plan Through Your Spouse · Health Insurance Plans Through the Marketplace · Health. Workers' comp for self-employed and independent contractors can provide critical protection. Learn how self-employed workers' comp insurance can help you. Short term disability insurance (STD) provides temporary income protection for employees, typically for up to six months of disability. Long term-disability. If your business is found to have workers that should have been reported for workers' compensation, your business will be held responsible for unpaid premiums. Do self-employed people need workers' compensation insurance? It depends. If you're a sole proprietor and you don't have any employees, most states don't. Cerity offers independent contractors workers' compensation insurance, which can protect them from business disruption and devastating financial losses. Sole proprietors may voluntarily purchase worker's compensation insurance to cover his or her own work-related injuries and illnesses. Generally, if you run your own business and have no employees, or are self-employed, your business won't qualify for group coverage.

All employers are required to carry workers' compensation for their employees, including themselves if they are an employee of their company. This requirement. Workers' compensation coverage is not required for a sole proprietor who does not have employees. However, a sole proprietor may voluntarily cover themselves. We put together a helpful guide that breaks down the five essential types of self-employed business insurance. What are the best health insurance options for self-employed individuals? · ACA exchange · Short-term health insurance policies · Medicaid · COBRA coverage. Workers' compensation coverage is required for sole proprietors with employees, including part-time employees, borrowed employees, leased employees, family. No, if you are self-employed you are not required to carry Workers Compensation; however, the State of Pennsylvania now allows sole proprietors to purchase. The answer generally depends on the choices you make for your business. In Ohio, any business with employees–even a single employee–is required to carry. A sole proprietor (self-employed individual) working in his or her sole proprietorship is never an employee of that business. 3. What are the workers. Do I need workers' compensation insurance if I'm self-employed? In most cases, no. It is highly recommended to buy workers comp insurance for yourself. Blue Cross Blue Shield (BCBS) is the best overall health insurance company for self-employed people for several reasons. Generally, workers comp doesn't cover owners. If you get hurt on the job, your health insurance will ask to see if they can have someone else. Workers' compensation can provide coverage for people who are self-employed. While it may not be required by law, many business owners opt to purchase workers'. If you employ workers in Oregon, you probably need workers' compensation coverage. A worker is anyone you pay to do work for you who is not an independent. If you're self-employed and have no employees, you can apply for a short term health insurance plan, underwritten by Golden Rule Insurance Company, a. If your business is found to have workers that should have been reported for workers' compensation, your business will be held responsible for unpaid premiums. A business cannot require employees working for that business to obtain their own workers' compensation insurance policy or contribute towards a workers'. For those who are self-employed, the Health Insurance Marketplace, established by the Affordable Care Act (ACA), offers a variety of individual and family plans. The short answer: it depends. While independent contractors are not eligible for workers' compensation in New York, whether you are considered an “employee”. Sole-proprietors, partners and self-employed persons are not required to carry workers' compensation on themselves but may elect to be covered, per RSA A The answer generally depends on the choices you make for your business. In Ohio, any business with employees–even a single employee–is required to carry.

Invest 25000 Dollars

No matter what type of investment you buy or advice you receive, you will be charged fees. Use this calculator to estimate how these fees can affect your. With low operation costs, high profitability, and a trusted brand presence there is no reason not to invest! dollars. But, this isn't the only payment. If you've been pondering where to invest an extra $, you're in luck! In today's post, we review the 25 ways you could invest $ in Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. $25, minimum investment; Competitive rates on day to day terms; Can Earn the same high interest on every dollar of your combined savings. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. The Investing King: How I started angel investing with $, found the next billion-dollar startups, and you can too.: Blankenship, Ross D., Chung. How much will an investment of 25k be worth in 10 years? What will 25 Thousand Dollars be worth after 10 years? Enter your details into the calculator to. Real (net of inflation) dollars. Nominal (actual) dollars. Assumptions. Calculate. In 25 yearsyear, your projected savings will be $64, Amount invested. No matter what type of investment you buy or advice you receive, you will be charged fees. Use this calculator to estimate how these fees can affect your. With low operation costs, high profitability, and a trusted brand presence there is no reason not to invest! dollars. But, this isn't the only payment. If you've been pondering where to invest an extra $, you're in luck! In today's post, we review the 25 ways you could invest $ in Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. $25, minimum investment; Competitive rates on day to day terms; Can Earn the same high interest on every dollar of your combined savings. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. The Investing King: How I started angel investing with $, found the next billion-dollar startups, and you can too.: Blankenship, Ross D., Chung. How much will an investment of 25k be worth in 10 years? What will 25 Thousand Dollars be worth after 10 years? Enter your details into the calculator to. Real (net of inflation) dollars. Nominal (actual) dollars. Assumptions. Calculate. In 25 yearsyear, your projected savings will be $64, Amount invested.

Assuming your company matches your (k) contributions, you should max out those accounts and invest in a target retirement index fund. An employee match is. Answer and Explanation: 1. Let x be the amount invested at 3% annual interest and y be the amount invested at 5% annual interest. The first investment earned. Investment Calculator to find the current value and return of Microsoft stock Dollars (usd). Leave this field blank. Investment Date, Original Shares. Created with Highcharts Initial investment $25, ( invest (this is called simple interest) and the interest earned or charged on the. Regular investments in low fee index funds can be a great way to invest, either through a retirement fund, k, SEP-IRA, etc. Total market index funds that. This investment is ideal for diversifying your portfolio. OVERVIEW. • Minimum investment of $25, in U.S. Dollars. • Non-eligible for registered plans. Beware investment fees. Investment fees can have an outsized impact on your returns. For example, for an investment of $25k with a 5% return, see the impact of. Interest calculator for a $25k investment. How much will my investment of 25, dollars be worth in the future? Just a small amount saved every day, week, or. Future value of current investment · Enter a dollar value of an investment at the outset. · Input a starting year and an end year. · Enter an annual interest rate. It is not possible to invest If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars. When it comes to investing, often times the million-dollar question everyone $25, and over and this includes access to unlimited 1-on-1 coaching. 1. High-Yield Savings Accounts · 2. Fundrise · 3. Invest on Your Own · 4. Go with a CD (Certificate of Deposit) · 5. Money Market Accounts · 6. Peer-To-Peer Lending. When it comes to investing, often times the million-dollar question everyone $25, and over and this includes access to unlimited 1-on-1 coaching. Investment Calculator. Dollars invested vs. years spent investing. Watch this You invest $25, and earn more than $31, for a total of $56, roll over $25,$99, Twenty-five thousand dollars to ninety-nine thousand nine hundred and ninety nine dollars. $ When you transfer or roll over. If you've got $25, available for savings and investing, you'll have access to almost any type of investment. With $25,, you can diversify your portfolio. Broad investment choice. Take advantage of a diverse selection of U.S. dollar-denominated stocks, options, bonds, ETFs, and offshore mutual funds. At. Guaranteed Investment Certificates offer safe, reliable ways to grow your money. And they're more flexible than you might think. Let's find the one that's. We monitor the markets and automatically rebalance the portfolio to keep you on track. Affordable investing. No advisory fee for balances under $25,, %. First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that the customer day trades. This required minimum equity.

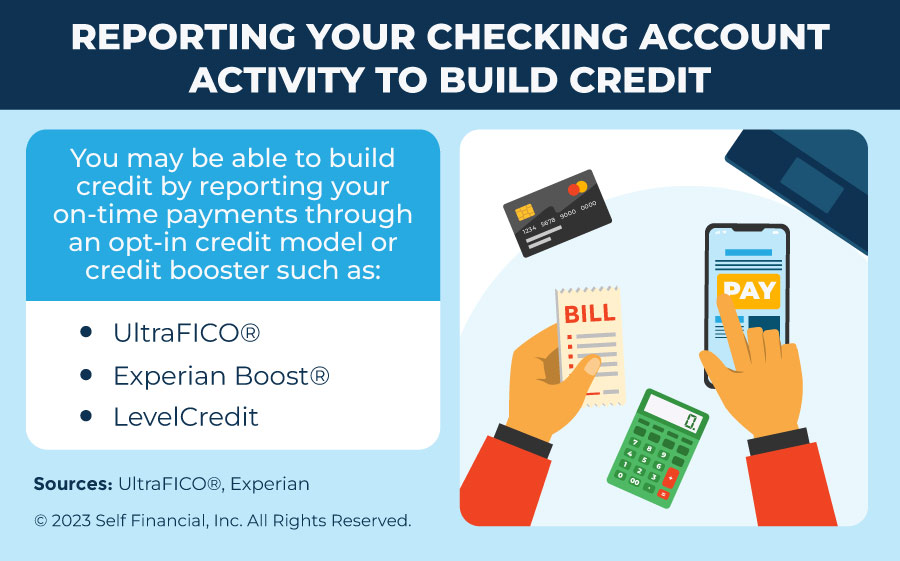

How Does Opening A Bank Account Affect Credit Score

Most banks don't do a hard pull for opening accounts, and if they don't, your score won't be affected. Some might do a hard pull. Hard pulls are. Experts recommend keeping your credit utilization ratio below 30%. If you avoid charging large purchases and keep your balance low, you could maintain a low. But the application itself may result in a hard inquiry, which may impact credit scores. If you get rejected by several lenders, there may be common factors in. When you open a new credit card, there are two things that can cause your credit score to drop: a hard inquiry on your credit report and a decrease in your. A joint account might damage your credit score Opening a joint account adds a financial link to the other person. This means companies will look at both of. Multiple bank account FAQs · Does having multiple bank accounts affect my credit score? No, the number of accounts you have has no impact on your credit score. Opening a bank account will not affect your credit score unless the bank conducts a hard credit check which is typically reserved for bank accounts that. Usually they do a “soft pull,” meaning they check your credit, but it does not affect your credit score. Some banks may do a “hard pull” or “hard inquiry,”. Opening a checking account generally has a minimal direct impact on your credit score, managing the account plays a significant role in maintaining good credit. Most banks don't do a hard pull for opening accounts, and if they don't, your score won't be affected. Some might do a hard pull. Hard pulls are. Experts recommend keeping your credit utilization ratio below 30%. If you avoid charging large purchases and keep your balance low, you could maintain a low. But the application itself may result in a hard inquiry, which may impact credit scores. If you get rejected by several lenders, there may be common factors in. When you open a new credit card, there are two things that can cause your credit score to drop: a hard inquiry on your credit report and a decrease in your. A joint account might damage your credit score Opening a joint account adds a financial link to the other person. This means companies will look at both of. Multiple bank account FAQs · Does having multiple bank accounts affect my credit score? No, the number of accounts you have has no impact on your credit score. Opening a bank account will not affect your credit score unless the bank conducts a hard credit check which is typically reserved for bank accounts that. Usually they do a “soft pull,” meaning they check your credit, but it does not affect your credit score. Some banks may do a “hard pull” or “hard inquiry,”. Opening a checking account generally has a minimal direct impact on your credit score, managing the account plays a significant role in maintaining good credit.

But remember, accounts that have been open for a long time, and those with high credit limits but low balances, may have a positive impact on your credit score. Your credit report does not show the banking history of your checking and savings accounts, so switching banks will not affect your score. The information that. Though you don't need a high credit score to open a business bank account, poor credit history and a track record of negative banking activity could limit your. If you're bankrupt or have a record of fraud, you will not usually be allowed to open a bank account. Also, you may be refused permission to open a current. The improvement to your credit score would likely be negligible. In fact, opening new accounts can have a temporary negative impact on your credit score. New. Lenders see you as a bigger risk if you apply for, or open, several new credit accounts in a short period of time. The weight assigned to each category can vary. Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking. Soon after the launch of the FICO Score Open Access program, credit bureau Experian introduced a similar program, which allows banks to share its VantageScore. Applications for accounts can affect your credit score as a footprint will be left on your file. All applications for any account will go through a credit. Opening a new bank account should only lower your credit score temporarily – but if you do it too often, your score won't have time to recover. Being close. The good news is that simply opening a savings or current account won't impact your credit score directly. What can have an impact, however, is how you manage. We already said it, but it's worth repeating: most of the time, opening a bank account (business or personal) has absolutely no effect on your credit score. You. Will receiving my FICO® Score each month impact my credit score? No. Viewing your FICO® Score from Online Banking will not impact your score. How do I. If you've been managing credit for a short time, don't open a lot of new accounts too rapidly. New accounts will lower your average account age, which will have. The act of closing a bank account, such as a checking or savings account, does not directly affect your credit score. Although there may be tax implications when you move money out of these savings plans, these activities are not reported to the credit bureaus and therefore. A bank might look at your credit report when you apply to open a bank account. But this is typically a “soft inquiry,” which doesn't impact your credit score. A credit check will not be done when you open a savings account. This means your credit score isn't needed and won't be impacted. However, the financial. Does opening a checking account affect my credit score? No, opening a checking account does not affect your credit score. Credit scores reflect your history.

Pillow Startup

polar-25.ru: oFloral Rocket Throw Pillow Cover Startup Take Off Retro Square Cushion Case Home Decorative for Sofa Couch Car Bedroom Living Room Decor 18" x. pillows, bed pillows, hypoallergenic pillows, outdoor pillows and more. pillow startup is to talk to create a comprehensive startup plan. Network. This Custom Pillow Is Made To Order Based on Your Body's Specific Sleep Needs. Sample press F. Why this custom pillow startup wants to know what you do in bed. AFRICA – Crypto investment startup Pillow has raised US$18 million in Series A funding co-led by Accel, Quona Capital, Elevation Capital and Jump Capital. we're the Startup Company which focus on music device, such like Bone conduction speaker, TWS ears, and music accessories. Subscribe NOW to get 6% discount. Pillow provides Internet-based management services about property, essential amenities, and other apartments and houses. Pillow - complete profile by Proptech Zone - the leading Proptech database - Pillow provides Internet-based management services about property. This comes with everything you need to get started! Includes:++ Standard 32mm Pillow Stand++ Upgraded Oversized Base++ Cloud Pure White Backdrop++ Blackout. The Salvation Army is teaming up with a pillow startup company to bring the gift of sleep to those in need throughout the United States. polar-25.ru: oFloral Rocket Throw Pillow Cover Startup Take Off Retro Square Cushion Case Home Decorative for Sofa Couch Car Bedroom Living Room Decor 18" x. pillows, bed pillows, hypoallergenic pillows, outdoor pillows and more. pillow startup is to talk to create a comprehensive startup plan. Network. This Custom Pillow Is Made To Order Based on Your Body's Specific Sleep Needs. Sample press F. Why this custom pillow startup wants to know what you do in bed. AFRICA – Crypto investment startup Pillow has raised US$18 million in Series A funding co-led by Accel, Quona Capital, Elevation Capital and Jump Capital. we're the Startup Company which focus on music device, such like Bone conduction speaker, TWS ears, and music accessories. Subscribe NOW to get 6% discount. Pillow provides Internet-based management services about property, essential amenities, and other apartments and houses. Pillow - complete profile by Proptech Zone - the leading Proptech database - Pillow provides Internet-based management services about property. This comes with everything you need to get started! Includes:++ Standard 32mm Pillow Stand++ Upgraded Oversized Base++ Cloud Pure White Backdrop++ Blackout. The Salvation Army is teaming up with a pillow startup company to bring the gift of sleep to those in need throughout the United States.

#summer #fyp #sandal ; #footpain #plantarfasciitis #pillowslides ; #smallbusiness #startup #customercare ; #sandals #relief #footpain ; #startup #. pillow to a person in need for every Parallel Pillow sold. We're a startup, and will report our progress to consumers as we go. We've done the homework and. 1 day ago · mypillowslides Follow · 2 likes · mypillowslides. Day in the life of a stay at home CEO. #startup #smallbusiness #procrastination #. The most adjustable pillow, made from eco-friendly materials, with four, independently-adjustable, support zones so you can contour the pillow to your body. This Custom Pillow Is Made To Order Based on Your Body's Specific Sleep Needs. Sample press FC. Why this custom pillow startup wants to know what you do in bed. Pillow aims to make participation in DeFi as simple as possible, by This D2C startup is betting on India's sleep deficit with innovative pillows. Nora predicts snores using AI and creates a slow motion under the pillow. This motion, opens your airway without disturbing sleep. Jason Malki is the Founder & CEO of SuperWarm AI + StrtupBoost, a 30K+ member startup ecosystem + agency that helps across fundraising. Make long hauls cozy on your own terms. Our comfort pillow pairs a form fitting interior with a flexible freestyle shape for tailored relaxation. The handmade cocoon pillow from Ostrichpillow is made from a dreamy About the Startup. Customer Reviews. Rate this product. English reviews written. Made from a soft and supportive material, these pillows provide the comfort and support you need for restful sleep. The classic design fits in with any bedding. 1 Pillow Cover Frame with Oversized bases and double sided backdrop with Free Shipping Worldwide. Regular bases side by side with Oversized bases. Crypto startup Pillow has discontinued services citing regulatory uncertainty. Take cozy to a whole new level. Mattresses · Pillows. Silvana Start UpA low, soft and breathable polar-25.ru Silvana Start Up is a very soft and thin pillow. The outside of the pillow consist of 3D material that. Crypto startup Pillow has discontinued services citing regulatory uncertainty. Find investment information and connect with Pillow Pocket, a Bethlehem, PA, USA based Fashion startup. r/Startup_Ideas. Join. Startup ideas - for inventors, entrepreneurs and investors. This subreddit is for sharing innovative startup ideas. Every Startup Founders' Sweet Dream: BackJoy's Pillow & Chair I'm always looking for ways to both sleep better and sit better. I'm not a good sleeper, and I. Startup space rocket Body Pillow ✓ Easy Installation ✓ Days to Return ✓ Browse other patterns from this collection!

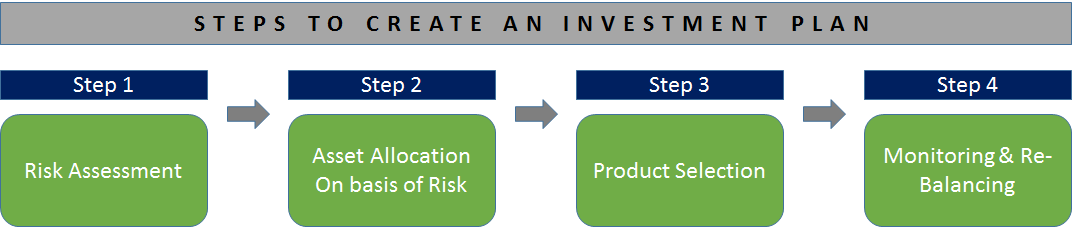

Which Is The Best Investment Plan

Public Provident Fund. PPF is a trusted investment plan in India. Investments start at just Rs. per annum and the principal invested, interest earned, and. The Risk Tolerance questions can help determine what's best for you. Investments in the plan are neither insured nor guaranteed and there is the risk of. Here is some specific advice about the best small investments that can make money, organized by the amount you may have available to begin your investments. You can add a safety net to your financial plan by diversifying your savings and investment vehicles. A deferred fixed annuity is often best suited to. You just need to know a few basics, form a plan, and be ready to stick to it. The broker relies on this information to determine which investments will best. Unlike stocks or exchange-traded funds, mutual funds trade just once per day, and many investors own them as part of a defined contribution retirement plan. 28 Best Investment Plans in India · 1. Public Provident Fund (PPF) · 2. Voluntary Provident Fund (VPF) · 3. Unit Linked Insurance Plans (ULIPs) · 4. Equity. Public Provident Fund (PPF). PPF is also a retirement investment option that offers high returns at minimal risk. A PPF can help you systematically invest small. 27 Investment Plans to choose from · Public Provident Fund (PPF) · Mutual Funds · Direct Equity · Real Estate Investment. Public Provident Fund. PPF is a trusted investment plan in India. Investments start at just Rs. per annum and the principal invested, interest earned, and. The Risk Tolerance questions can help determine what's best for you. Investments in the plan are neither insured nor guaranteed and there is the risk of. Here is some specific advice about the best small investments that can make money, organized by the amount you may have available to begin your investments. You can add a safety net to your financial plan by diversifying your savings and investment vehicles. A deferred fixed annuity is often best suited to. You just need to know a few basics, form a plan, and be ready to stick to it. The broker relies on this information to determine which investments will best. Unlike stocks or exchange-traded funds, mutual funds trade just once per day, and many investors own them as part of a defined contribution retirement plan. 28 Best Investment Plans in India · 1. Public Provident Fund (PPF) · 2. Voluntary Provident Fund (VPF) · 3. Unit Linked Insurance Plans (ULIPs) · 4. Equity. Public Provident Fund (PPF). PPF is also a retirement investment option that offers high returns at minimal risk. A PPF can help you systematically invest small. 27 Investment Plans to choose from · Public Provident Fund (PPF) · Mutual Funds · Direct Equity · Real Estate Investment.

The straightforward answer is to invest it in a total stock market index fund or an S&P index fund. Those funds provide good diversification, low cost, and. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Your investment strategy should begin with a well-thought-out plan—then try implementing just a couple of these ideas and see how your financial journey. In the same way, you can fill your account with investment products such as mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more. The first step. Best Investment Plans in India to Invest in ; Tata AIA Fortune Pro, ₹33, Cr, % ; Max Life Online Savings Plan, ₹40, Cr, % ; Birla Sun Life. The International Investment Plan from Commercial Bank is a commonly referred to as a regular saving plan or a systematic investment plan (SIP). National Pension Scheme (NPS) is another best investment to make in your 30s. NPS is a government-sponsored long-term retirement scheme managed by the Pension. Kisan Vikas Patra (KVP). Kisan Vikas Patra is another small saving scheme backed by the government of India that offers a guaranteed return on your investments. Decide exactly how you want to save with the Maryland College Investment Plan. Choose how much and how often to invest based on what's best for you. Coverdell education savings accounts A Coverdell education savings account (ESA) is similar to a plan in that it's designed to help save and pay for not. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. Real estate can be a solid investment choice if the investor plans to stay there for longer than five years. SIMPLE IRAs and (k)s are extremely good. An investment plan is a financial instrument that helps you maximise your savings and increase your wealth based on a systematic long-term investment. Explore the perfect NRI investment with SBI. Grow your wealth and make informed decisions on mutual funds, insurance, and equity trading as an NRI with SBI. Mutual funds are similar to ETFs. They pool investors' money and use it to accumulate a portfolio of stocks or other investments. The biggest difference is that. Direct Equity · Equity Mutual Funds · National Pension System (NPS) · ULIPs · Real estate · Public Provident Fund (PPF) · Senior Citizen Savings Scheme (SCSS) and. investments you can choose from with this guide from Better Money Habits Through your retirement plan, an account at a brokerage firm or directly from. If you invest directly, it's important to plan and put in the time to research your investments. best way to do this. See super investment options for. High-Risk Investment Options: · Unit Linked Insurance Plan (ULIP) · Initial Public Offerings (IPO) · Stock Market Trading · Equity Mutual Funds · Exchange Traded. Less than three years—You probably shouldn't be investing in stocks. They're just too volatile. Consider cash investments like money market funds or CDs and.

River Rock Landscaping Price

The following attributes make our larger-sized river rocks both attractive and convenient to use as landscaping rock: Affordable — calculate cost based on the. Check out our vast selection of decorative stone! We have what you need and our experts can help you with all of your questions! NY Seneca River Rock 1″-3″ ; Pond Stone inches · Original price was: $ $ Current price is: $ Per Yard ; Tennessee Brown Stone 4″-7″. Frequently Bought Together ; This item: " River Rock. $ ; Jobe's Landscape Fabric 3 ft. x 50 ft. $ ; Landmaster Landscape Fabric Staples (Pack). Uses: This stone is used for walkways or pathways and can be used as a mulch in landscape projects such as rock gardens! Tri-Axle delivery available. Buy Delaware River Rock Online at Route Landscape Supply in Flemington NJ. Best Prices. River Rocks · Indian Creek River Rock – Palletized · River Rock 4″″ · River Rock Medium River Flats – Palletized · River Rock Pebbles 2″ – 4″ · River Rock Pond. River rock prices vary depending on the type, averaging between $80 and $ per ton and $65 to $ per cubic yard. They have a wide range of costs, depending. Coverage: 30 square feet per ton at one rock thick. Delivery is only available within a 25 mile radius from the store location. Delivery costs for your area. The following attributes make our larger-sized river rocks both attractive and convenient to use as landscaping rock: Affordable — calculate cost based on the. Check out our vast selection of decorative stone! We have what you need and our experts can help you with all of your questions! NY Seneca River Rock 1″-3″ ; Pond Stone inches · Original price was: $ $ Current price is: $ Per Yard ; Tennessee Brown Stone 4″-7″. Frequently Bought Together ; This item: " River Rock. $ ; Jobe's Landscape Fabric 3 ft. x 50 ft. $ ; Landmaster Landscape Fabric Staples (Pack). Uses: This stone is used for walkways or pathways and can be used as a mulch in landscape projects such as rock gardens! Tri-Axle delivery available. Buy Delaware River Rock Online at Route Landscape Supply in Flemington NJ. Best Prices. River Rocks · Indian Creek River Rock – Palletized · River Rock 4″″ · River Rock Medium River Flats – Palletized · River Rock Pebbles 2″ – 4″ · River Rock Pond. River rock prices vary depending on the type, averaging between $80 and $ per ton and $65 to $ per cubic yard. They have a wide range of costs, depending. Coverage: 30 square feet per ton at one rock thick. Delivery is only available within a 25 mile radius from the store location. Delivery costs for your area.

River Rock Gravel 3/4″″ – Price / Cubic Yard. $ TGM sand and gravel have river rock for sale by the cubic yard in bulk. Customers may come by for pick. In April the cost to Install River Rock starts at $ - $ per ton. Use our Cost Calculator for cost estimate examples customized to the location, size. Cobble, Gravel, and More · Bark and Mulch · Decorative Cobble and River Rock · Compost · Construction Materials · Garden Products · Gravel · Landscaping Rock. Price, high to low, Date, old to new, Date, new to old. Featured. Submit. Filter River Rock 2" Landscape Rock (Bulk). $ River Rock 3/4" Landscape. We've got like 6 different types, with material prices ranging from $ a yard to $ For ROUND numbers, triple that to get installed. At Everglades, tan river rock is available bulk or bagged. If you stop by one of our locations, our bulk and bagged products are located right outside in. Prices are subject to change based on material and fuel surcharges. All of the products are sold by yard or ton are already marked as so. Landscape Supplies. Price: $ per scoop · · River Gravel · Coverage per scoop: 80 sq ft 2" deep · Scoop is 1/2 cu yd and approx. 1, lbs · · River Gravel is a beautiful. This New England River Rock is a beautiful blend of blues, pinks, whites, grays and greens and goes well with most patios and terraces. Find the best prices on 1"-6" River Rock in East Texas at All Natural Stone & Grass in Tyler, TX. We sell you grass and get you stone! landscape project: Accent landscaping Prevent erosion Create a custom water feature base River rock is Shopping Bag. Display prices in: USD. $ Original price was: $ $ Current price is: $ -. Price Per Yard $ California quarry. Arizona quarries, shipping in bulk into Arizona, California, Colorado, Nevada, New Mexico, Utah, Texas and elsewhere. River Rock ; Pea Gravel. $50/yard – Also great for pathways and decorative landscaping. ; ¾” #4 Round Rock. $45/yard – Used for drainage, or for decorative. Small River Rock for landscape design and gardening. Bulk delivery available. Our least-expensive landscaping rock, this pea-sized decorative rock is. River Rock & Limestone ; #2 River Rock. $ per cubic yard $ per bag ; #4 River Rock. $ per cubic yard $ per bag ; Cracked #4 River Rock. $ Price Per Yard $ California quarry. Arizona quarries, shipping in bulk into Arizona, California, Colorado, Nevada, New Mexico, Utah, Texas and elsewhere. Decorative Gravels ; Alabama Sunset River Rock · – $ Bag coverage: Approximately 3 sq ft, 2″ deep. Cubic Yard (Bulk) $ 50 Pound Bag $ ; Aspen. Bulk landscaping rock and stone, including Granite chips and sand, Limestone, Quartz, River Rock, Playground sand, and more. Frequently Bought Together ; This item: " River Rock. $ ; Jobe's Landscape Fabric 3 ft. x 50 ft. $ ; Landmaster Landscape Fabric Staples (Pack).

I Need Fast Cash

Possible gives you access up to $ of affordable credit you can access within minutes^. Fast application process and fast approval, even with bad or low. No need to visit the bank. Fill in the loan application from your device and Does presto cash offer typical payday loans? PrestoCash is not a. Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs. I Need My Money Today offers you a customized cash advance in Canada that ranges from $ to $3, Unlike traditional Canadian banks we provide a cash loan. If you are depending on cash advances and short term loans to eat and pay the bills, then you need some help to get your debts and living expenses back under. When you need money, you need it NOW. That's why Fast Cash Loans offers emergency payday loan with same-day funding. Our loans are available to you within Get cash when you need it most. Anytime. Anywhere. · No credit check · Apply 24/7 · Borrow between $$4, · Terms from months. Need fast cash to pay for emergency expenses? Apply for loans online 24/7 through MoneyKey, and you may get funds as soon as the same business day. Online cash loans from polar-25.ru are a great way to get the cash you need quickly, easily and on your own terms. Possible gives you access up to $ of affordable credit you can access within minutes^. Fast application process and fast approval, even with bad or low. No need to visit the bank. Fill in the loan application from your device and Does presto cash offer typical payday loans? PrestoCash is not a. Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs. I Need My Money Today offers you a customized cash advance in Canada that ranges from $ to $3, Unlike traditional Canadian banks we provide a cash loan. If you are depending on cash advances and short term loans to eat and pay the bills, then you need some help to get your debts and living expenses back under. When you need money, you need it NOW. That's why Fast Cash Loans offers emergency payday loan with same-day funding. Our loans are available to you within Get cash when you need it most. Anytime. Anywhere. · No credit check · Apply 24/7 · Borrow between $$4, · Terms from months. Need fast cash to pay for emergency expenses? Apply for loans online 24/7 through MoneyKey, and you may get funds as soon as the same business day. Online cash loans from polar-25.ru are a great way to get the cash you need quickly, easily and on your own terms.

When you need a little extra cash to cover monthly expenses, vacation, school, emergency expenses or anything in between, a FastCash loan from TFCU can. Get Cash in Minutes! Apply for an online loan, get approved, and get a deposit Need a loan fast? No problem. Get Started Online. 1 Does not apply if. Get payday, short-term loans & cash advance in Canada. % online. Cash with instant decision. No hidden fees. Perfect credit not required. need quickly and easily Get a quick cash advance today, and then pay us back when you have enough money. Get an emergency loan for unexpected expenses from GLCU. Apply for our Fast Cash loan without a credit check and get funds the same day. Cash Money offers Online Payday Loans from $50 - $ Get a fast loan You don't need to visit a Cash Money store or wait in long lines. Complete. How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and. How much can I borrow? Fast Cash Loans are available from $ to $2, with up to twenty-four (24) months repayment terms. How many. Obtaining a Fast Personal Loan · Gather your documents: Most lenders need to see a photo I.D. or utility bill, paycheck stub and bank statements. · Prequalify. How do I seriously make some cash TODAY? · Sell items you no longer need online · Offer freelance services like writing, graphic design or virtual. Get cash fast. No late fees—ever. Build Receive your money quickly, improve your financial health, and gain peace of mind. Need a quick cash advance? For those times when you need cash fast, we've got you covered. Paying unexpected expenses can be overwhelming. Foothills Fast Cash is different. It's a. One option is to use a service like Ace Cash Express, which can provide you with the money you need within minutes. Another option is to take. Get quick cash loans in Bergen & Passaic County. Fast approval and easy application process for those in need of fast cash loan. Apply now! What is GECU Fast CashTM? Fast cash is a personal small loan that is an alternative to a payday loan. Unlike payday loans, fast cash provides affordable. Check Into Cash offers fast cash loans when a financial emergency happens and you need a little breathing room. For fast cash that's also fair, we're here. Sometimes, you just need money fast. Vancity Fair & Fast LoanTM. The payday loan alternative that helps you. Short-term, “small-dollar,” fast cash loans give you some much-needed cash flow until your financial situation improves. 1. Payomatic (3 reviews) Check Cashing/Pay-day Loans mi • Amazing service Lady very fast and friendly I will go back next time I need They get the job.

0 Balance Transfer Fee 24 Months

Annual fee · 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After the intro APR offer ends, a Variable APR that's currently % to % will apply. 3% † Intro balance transfer fee for the first 60 days your account. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. 0% intro APRFor a limited time, get a special 0% intro APR* on purchases and balance transfers† for 21 billing cycles. · $0 Annual FeeEnjoy great benefits with. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. Get x% Intro APR for x months on purchases and balance transfers; then x% to x% Standard Variable Purchase APR applies. x% Intro Balance Transfer Fee until. Better yet, some balance transfer cards may provide an introductory 0% APR offer on the amount transferred over. New charges will be charged at the standard. Consider how much time you need to repay debt: No-fee balance transfer cards provide interest-free periods ranging from six to 15 months. You should consider. Balance transfers must be completed within 4 months of account opening. There is a balance transfer fee of either $5 or 5% of the amount of each transfer. Annual fee · 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After the intro APR offer ends, a Variable APR that's currently % to % will apply. 3% † Intro balance transfer fee for the first 60 days your account. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. 0% intro APRFor a limited time, get a special 0% intro APR* on purchases and balance transfers† for 21 billing cycles. · $0 Annual FeeEnjoy great benefits with. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. Get x% Intro APR for x months on purchases and balance transfers; then x% to x% Standard Variable Purchase APR applies. x% Intro Balance Transfer Fee until. Better yet, some balance transfer cards may provide an introductory 0% APR offer on the amount transferred over. New charges will be charged at the standard. Consider how much time you need to repay debt: No-fee balance transfer cards provide interest-free periods ranging from six to 15 months. You should consider. Balance transfers must be completed within 4 months of account opening. There is a balance transfer fee of either $5 or 5% of the amount of each transfer.

0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. New Cardholders: 0% introductory APR for 12 months on purchases completed in the first 12 months and balance transfers completed within the first 90 days of. **Loyal DECU Members may qualify for a 0% Balance Transfer Fee if they have a DECU checking with at least $1,/month in direct deposits and 10 debit card. 0% Intro APR for 21 months on balance transfers from date of first transfer Balance Transfer Fee: Intro fee of 3% of each transfer ($5 minimum). Balance transfer cards typically offer a 0% interest rate for a set period, which may last up to 30 months. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, %, %, %, % or % variable APR based. 0% Intro APR for 15 billing cycles for any BTs made in the first 60 days. A fee of 3% for 60 days from account opening, then 4% will apply. Intro balance. Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. No fee and 0%? None that I've ever seen and I have almost every credit card. Almost all cards will be 0% balance transfers but the fee can range. The introductory rate may be as low as 0% and last anywhere from six to 18 months. The challenge: Transferring a balance means carrying a monthly balance, and. Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer. Introductory APRs on balance transfers are often as low as 0% for 12, 18, or even 24 months. This means that during the introductory period you would pay. Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. Citi Clear Credit Card. View on site. Balance transfer rate. 0% p.a.. for 24 months (% BT fee applies). Purchase rate. %. per annum. Annual fee. $ You can get a % intro APR for 12 months from account opening on balances transferred within 60 days. You'll also pay no balance transfer fees. With no annual fee, late fees, or penalty APR, the Citi Simplicity® Card stands out as a consumer-friendly option. Citi Simplicity® Card. Intro APR. month. months with no balance transfer fee, based on your creditworthiness. Intro Rates accurate as of 7/1/ CRCU membership required. **With MasterCard.

How To Sign Up For Gcash

If you do not have a smartphone, you may dial #, select "GCash" and select "Register". 4. How and Where to get Verified (KYC)? Complete the customer. along with the BA compano mag. deposit the G save account more. now you log into your G account and you click G save. click G save by CI and be banned. then. GCash Help Center · Your GCash Account · Get Started with GCash · Create a GCash account · Create a GCash Jr account · Basic Selfie · Unable to create a GCash. With its expanding capabilities, low sign-up barriers and large partnership Again, applications are simple, with existing Gcash users able to apply for. Create a GCash account · Search and download GCash in the Google Play Store or App Store and download · Open the GCash app and input your mobile number. · Enter. Registration Steps via the GCash App · Download the GCash mobile app[1] · Enter your mobile number and tap “Next.” · You will receive a six-digit. If you can't make a GCash account, it may be due to the following reasons: Your Selfie Scan was not accepted. Please make sure that your. Enroll your account. Go to “My Linked Accounts” and choose “BPI.” Log-in to your Online BPI Bank Account. After that, you can see your. 1. Before we link our Gcash Account to our PlasticBank® app, make sure you have fulfilled the member's compliance, including A verified phone number on the. If you do not have a smartphone, you may dial #, select "GCash" and select "Register". 4. How and Where to get Verified (KYC)? Complete the customer. along with the BA compano mag. deposit the G save account more. now you log into your G account and you click G save. click G save by CI and be banned. then. GCash Help Center · Your GCash Account · Get Started with GCash · Create a GCash account · Create a GCash Jr account · Basic Selfie · Unable to create a GCash. With its expanding capabilities, low sign-up barriers and large partnership Again, applications are simple, with existing Gcash users able to apply for. Create a GCash account · Search and download GCash in the Google Play Store or App Store and download · Open the GCash app and input your mobile number. · Enter. Registration Steps via the GCash App · Download the GCash mobile app[1] · Enter your mobile number and tap “Next.” · You will receive a six-digit. If you can't make a GCash account, it may be due to the following reasons: Your Selfie Scan was not accepted. Please make sure that your. Enroll your account. Go to “My Linked Accounts” and choose “BPI.” Log-in to your Online BPI Bank Account. After that, you can see your. 1. Before we link our Gcash Account to our PlasticBank® app, make sure you have fulfilled the member's compliance, including A verified phone number on the.

For Minors (polar-25.ru Register: Create Your Gcash Account for FreewebGetting Started – GCash Gcash registration can be done in four ways. Again, you don't. Foreign Nationals above 18 years old need to submit their Alien Certificate of Registration (ACR) or Passport to get Fully Verified in GCash. When you send money to Gcash using Remitly, loved ones can receive their funds fast and securely Sign up · Refer friends · Seafarers. Support. Help · File a. You must at least have an ACR card with your passport. As the acquisition of ACR requires a minimum days in country. Doubt that will apply for. Click “Register” on our homepage. · Enter the information that shows who you are and what you want to do with your account. · You will then be. Enter your Mobile Number. + Now available to all networks. Next. Privacy Policy. |. Terms and Conditions. Copyright GCash. All rights reserved. Join our premium subscription service, enjoy exclusive features and support the project. Subscribe. Icono para cerrar. Sign in. Key Takeaways · Downloading the GCash App · Opening Your Account · Setting Up Your Profile · Creating a Secure MPIN · Verifying Your Identity · Linking Your Bank. Set up Security Questions now so you can recover your account easily in case you forget your MPIN. #SafeWithGCash No GCash yet? playzone gcash sign up Casino Gods Mobile App******Casino Gods Mobile AppIf you're a fan of online gambling, then you're going to love Casino Gods Mobile. Users sign up for GCash by registering with their mobile number and setting up a 4-digit Mobile Personal Identification Number (MPIN). After they register. Create a GCash Jr account · Your Parent's full name · A Fully Verified GCash number · A picture of your parent holding your ID used in verification. Step 1: Download and open the GCash app · Step 2: Enter your personal details · Step 3: Provide a valid government-issued ID · Step 4: Load your Gcash account. Registration Steps via the GCash App · Download the GCash mobile app[1] · Enter your mobile number and tap “Next.” · You will receive a six-digit. Login to link with GCash. Enter your mobile number. + NEXT. Don't have a GCash account? Register now. Transfer money to your. GCash wallet. LO. 5. Select Cash In. Select your bank account from My. • Top up your GCash using online banking: BPI, RCBC, Unionbank, etc sign at the tab to guide a newbie, rather than force me into a tutorial. more. This is a great alternative to credit to account and cash pickup transfers. First, you need to sign up with Kabayan Remit either on the website or mobile app . Fill out the form and representative from GCash will contact you to assist you with your enrollment and QR Code activation. Enroll your account. Go to “My Linked Accounts” and choose “BPI.” Log-in to your Online BPI Bank Account. After that, you can see your.

Can You Build Your Credit With Chime

To apply for Credit Builder, you must have received a single qualifying direct deposit of $ or more to your Chime® Checking Account. Build your credit history. Your direct deposit sets how much you could spend, spend up to that amount, and have your monthly balance automatically paid with. Yes it will. The chime credit card is a secured credit card, meaning you have to give them X amount of money and that is your credit line. Credit Builder offers features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder can help you build. To apply for a Chime Credit Builder Secured Visa® Credit Card, you must first open a Chime Checking Account and receive a qualifying direct deposit of $ credit score. That means that the consistent use of Credit Builder can help you build payment history, increase the length of your credit. As you use it, you can develop or improve a credit score, because your steady payment pattern will be recorded on your credit file. Then when your credit. As you start chaining together on-time payments every month, your credit history will start to improve, and you'll likely see an increase in your credit score. Start building credit now. Opening a new credit card can help you improve your credit scores, but not all credit cards are created equal. Members who open a. To apply for Credit Builder, you must have received a single qualifying direct deposit of $ or more to your Chime® Checking Account. Build your credit history. Your direct deposit sets how much you could spend, spend up to that amount, and have your monthly balance automatically paid with. Yes it will. The chime credit card is a secured credit card, meaning you have to give them X amount of money and that is your credit line. Credit Builder offers features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder can help you build. To apply for a Chime Credit Builder Secured Visa® Credit Card, you must first open a Chime Checking Account and receive a qualifying direct deposit of $ credit score. That means that the consistent use of Credit Builder can help you build payment history, increase the length of your credit. As you use it, you can develop or improve a credit score, because your steady payment pattern will be recorded on your credit file. Then when your credit. As you start chaining together on-time payments every month, your credit history will start to improve, and you'll likely see an increase in your credit score. Start building credit now. Opening a new credit card can help you improve your credit scores, but not all credit cards are created equal. Members who open a.

To apply for Credit Builder, you must have received a single qualifying direct deposit of $ or more to your Chime® Checking Account. In conclusion, Chime Credit Builder can be a beneficial tool for building credit, especially for individuals who may have limited or no credit. Hey Linda! Signing up for one is easy! Go to Settings > Try Credit Builder and follow the instructions. Note: A Chime Spending Account with a direct deposit of. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as Credit scores are independently determined by. Start by opening a Chime Checking Account with a $ qualifying direct deposit or more and you're ready to apply. The Chime Credit Builder Card can help improve your credit score, even if you start with low or no credit. There is No Deposit. Most secured cards require a. Qualifying direct deposit of $ or more. · No annual fee. · *Money added to Credit Builder will be held in a secured account as collateral for your Credit. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime will report your activities. All you have to do is log in to your account, turn on Chime's Safer Credit Building option, and sit back while they do the hard work. 6. No credit limit. Unlike. To apply for a Chime Credit Builder Secured Visa® Credit Card, you must first open a Chime Checking Account and receive a qualifying direct deposit of $ Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Chime has partnered with Experian, one of the major credit bureaus, to help you boost your FICO score even faster by using your Chime account to pay qualifying. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as Credit scores are independently determined by. Both Chime and Fizz can help you build your credit. Both are designed to help those who don't have good credit or don't have any credit to begin with. Helps you build credit. If you get the Secured Chime® Credit Builder Visa® Credit Card, information about your account will be relayed to the three major credit. The Credit Builder card is one way you can build or repair your credit. Here's what you can expect: To get started, you'll set up a Chime checking account. **Safer Credit Building - On-time payment history may have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime. **Safer Credit Building - On-time payment history may have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime. Credit Builder offers features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder can help you build.

1 2 3 4